Opportunities and challenges for B.C. housing ahead of the election

Researchers at the UBC Housing Research Collective outline opportunities and challenges for housing in the province ahead of voting next month.

Photo by Tolu Olubode on Unsplash

Housing will be a key issue for B.C. voters ahead of the provincial election in October.

B.C. leads other provinces when it comes to housing construction but the province remains the epicentre of Canada’s housing crisis.

Drs. Alexandra Flynn (AF) and Craig Jones (CJ), director and associate director of the UBC Housing Research Collective, outline opportunities and challenges for housing in the province ahead of voting next month.

What is the state of housing in B.C.?

CJ: There is a national housing crisis in Canada, where demand for affordable housing is outstripping supply.

The housing crisis has been further challenged by low rental vacancy rates. The rental vacancy rate measures the percentage of rental homes or spaces that are available for rent. As of October 2023, the national vacancy rate for purpose-built rental apartments reached a new low at 1.5 per cent and average rent growth reached a new high at eight per cent.

Across B.C., the vacancy rate in 2023 was 1.2 per cent, the lowest it has been since 2008. In the City of Vancouver, we have a rental vacancy rate that’s less than one per cent, one of the lowest rates in Canada. Average rents in 2021-2023 rose by 17 per cent. Vancouver remains the most expensive rental market in Canada at $2,464 average monthly rent for a 2-bedroom purpose-built apartment.

According to data from 2021, B.C. leads Canada with the highest eviction rate in the country, where an estimated 85 per cent are ‘no-fault,’ meaning the tenants were evicted for landlords’ own use, to sell the property, for demolition, conversion or major repairs. That’s compared with about 65 per cent nationally.

AF: However, changes to ‘missing middle’ housing like fourplexes, laneway houses, and affordable housing, coupled with federal investments in housing, have seen B.C. housing starts outpacing the rest of Canada, with B.C. constructing new homes at a rate 2.5 times higher per capita than Ontario. The majority of new home starts in B.C. are apartments. Vancouver’s housing starts are the highest in the province. Inflation, delays in municipal approvals and insufficient labour remain challenges. Land costs are also high in B.C., which can steer developers away from the province.

B.C. has also made a number of changes to residential tenancy legislation aimed at protecting renters, including more stringent requirements where landlords seek to end tenancies, improving wait times, giving tenants more time to dispute eviction notices, and introducing a rent freeze and eviction bans during certain periods of the pandemic.

What are the opportunities you see for housing in B.C.?

AF: One opportunity would be a transformation of the construction sector, including embracing modular housing, or housing that is constructed off-site in a factory and shipped to the site. Productivity in the construction sector hasn’t kept up with the rest of the economy.

Modular housing is 20- to 50-per cent faster to build, requires fewer workers, provides long-term financial savings, and can reduce energy consumption, emissions and waste, addressing both sustainability and housing targets.

Another opportunity is underutilized publicly owned land. One of the biggest price tags for the construction of housing is the land that the housing sits on. Municipal, provincial and federal governments own hundreds of parcels of underutilized land in excellent locations and the HART Land Assessment Tool can help identify these areas. The federal government has been a leader in earmarking parcels, including the Jericho Lands, and in 2024 committed to an expansive Federal Lands Initiative.

What are the challenges you see?

CJ: There are a number of barriers to implementing off-site construction permitting and approval processes, and existing building codes and regulations.

For instance, most building code and inspection requirements refer to traditional construction methods, and it is difficult to apply to off-site construction.

Financing is another barrier. Construction financing is approved in a certain way, and once a particular milestone has been achieved, additional financing is released. In many cases, this milestone is defined as construction onsite. And, off-site construction has a larger upfront cost because you have to build a factory.

Featured Researcher

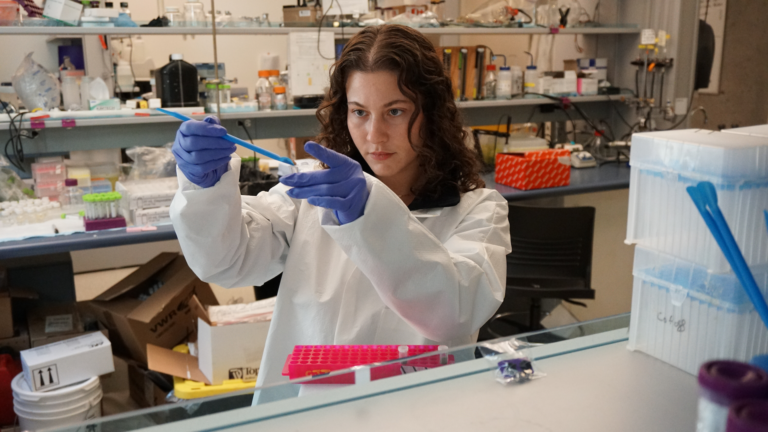

Dr. Alexandra Flynn, JD, LLM, PhD

Associate Professor, Peter A. Allard School of Law